Sheehey Furlong & Behm P.C. is proud to announce that fifteen of its attorneys have been recognized in the 2024 editions of The Best Lawyers in America, as well as Best Lawyers in America: Ones to Watch 2024. The publication recognizes over 66,000 American lawyers in more than 140 practice areas across all states. Recognition by Best Lawyers comes is the result of a peer review process which relies on the assessment of leading lawyers in the same geographical region and practice area as the recognized attorneys. Best Lawyers: Ones to Watch utilizes a similar peer review methodology to acknowledge lawyers earlier in their private practice careers.

Additionally, Sheehey attorney Diane McCarthy has been recognized as the 2024 Burlington Lawyer of the Year for Banking and Finance Law. Each year, this award is presented to one lawyer within each practice area and geographic region. Congratulations to Diane, and to all of the Sheehey attorneys who have been recognized for their work and professional abilities.

2024 Burlington Lawyer of the Year: Banking and Finance Law

Diane McCarthy

Sheehey Attorneys Recognized in the 2024 Edition of Best Lawyers in America include:

Ian Carleton

Sheehey Attorneys Recognized in the 2024 Edition of Best Lawyers: Ones to Watch include

Nathaniel Eisen

Sheehey Furlong & Behm is proud to announce its continued sponsorship of LUNAFEST, a traveling film festival showcasing award-winning films both by, and centered on, women. LUNAFEST is presented by Vermont Works for Women (VWW). Kevin Lumpkin, Sheehey partner and VWW board member, commented “Vermont Works for Women is doing tremendous and impactful work to advance gender equity and create a bright future for Vermont’s women and girls.”

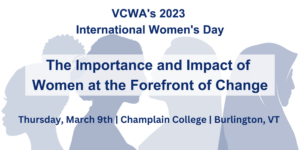

Sheehey Furlong & Behm is proud to announce its continued sponsorship of LUNAFEST, a traveling film festival showcasing award-winning films both by, and centered on, women. LUNAFEST is presented by Vermont Works for Women (VWW). Kevin Lumpkin, Sheehey partner and VWW board member, commented “Vermont Works for Women is doing tremendous and impactful work to advance gender equity and create a bright future for Vermont’s women and girls.” Sheehey Furlong & Behm is proud to announce its sponsorship of the inaugural International Women’s Day Networking Brunch hosted by the Vermont Council on World Affairs. The brunch, which will be held at the Champlain College Hawke Family Center, celebrates the influential work which women do on both the local and global scale. Its focus this year will be The Importance and Impact of Women at the Forefront of Change. Attendees will hear from Ambassador Adela Raz, Former Permanent Representative and Ambassador of Afghanistan to the United Nations and Ambassador from Afghanistan to the United States.

Sheehey Furlong & Behm is proud to announce its sponsorship of the inaugural International Women’s Day Networking Brunch hosted by the Vermont Council on World Affairs. The brunch, which will be held at the Champlain College Hawke Family Center, celebrates the influential work which women do on both the local and global scale. Its focus this year will be The Importance and Impact of Women at the Forefront of Change. Attendees will hear from Ambassador Adela Raz, Former Permanent Representative and Ambassador of Afghanistan to the United Nations and Ambassador from Afghanistan to the United States. Sheehey Furlong & Behm P.C. is pleased to announce that Attorney Matthew J. Greer has joined the firm as Of Counsel.

Sheehey Furlong & Behm P.C. is pleased to announce that Attorney Matthew J. Greer has joined the firm as Of Counsel.